The financial sector is undergoing a radical transformation as digital banks challenge conventional banking models. With seamless mobile experiences, lower fees, and innovative features, neobanks are attracting millions of customers worldwide. This comprehensive analysis explores how digital-only banks are reshaping finance, their competitive advantages, regulatory challenges, and what traditional institutions must do to compete in this new era of banking.

A. The Digital Banking Revolution

1. Explosive Market Growth

-

Global neobank users expected to reach 850 million by 2027

-

Digital banking sector growing at 47% CAGR

-

78% of millennials prefer digital-only banking solutions

2. Key Players Dominating the Space

-

Chime (12 million users in North America)

-

Revolut (25 million customers across 35 countries)

-

Nubank (70 million clients in Latin America)

-

KakaoBank (18 million users in South Korea)

3. Demographic Adoption Patterns

-

68% adoption among 18-34 year olds

-

42% penetration in urban areas vs 19% rural

-

3X faster growth in developing markets

B. Why Digital Banks Outperform Traditional Institutions

1. Cost Structure Advantages

-

No physical branches = 60% lower operating costs

-

Automated processes reduce staffing needs

-

Dynamic scaling capabilities

2. Enhanced User Experience

-

Account opening in <5 minutes

-

Real-time transaction notifications

-

AI-powered financial insights

-

24/7 customer service chatbots

3. Innovative Product Offerings

-

Fee-free international transfers

-

Early paycheck access

-

Automated savings tools

-

Cryptocurrency integration

C. Core Technologies Powering Neobanks

1. Cloud Computing Infrastructure

-

AWS and Azure-based core banking systems

-

Elastic scalability during peak demand

-

99.99% uptime guarantees

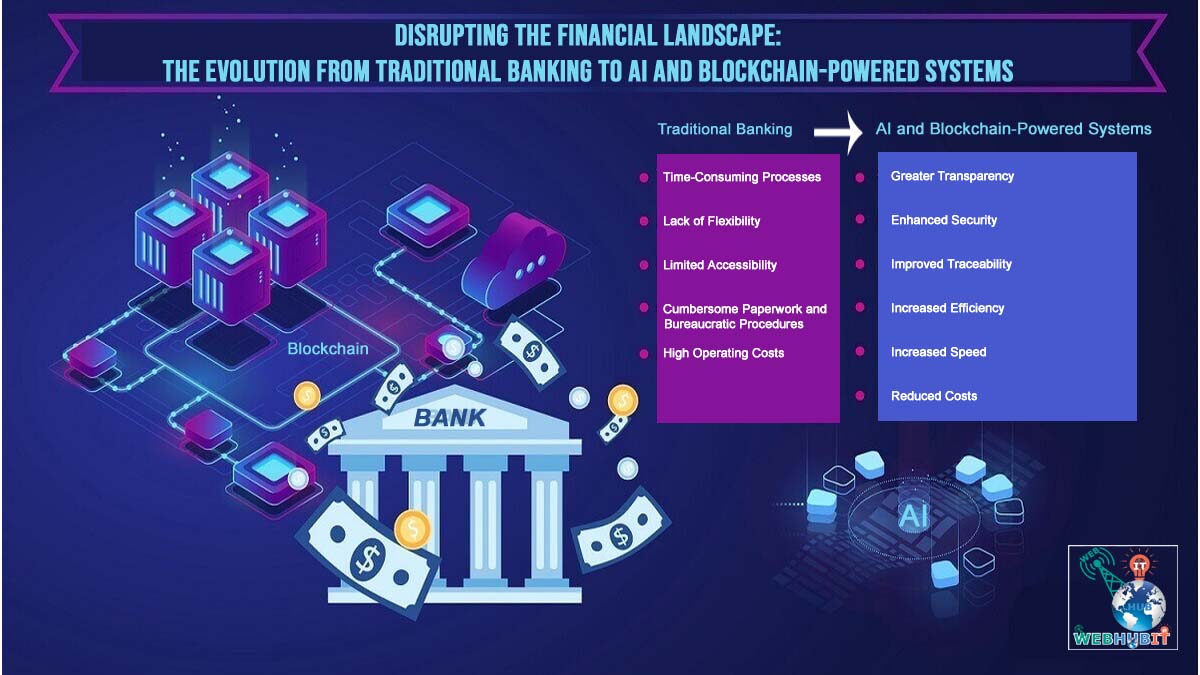

2. AI and Machine Learning Applications

-

Fraud detection algorithms

-

Personalized financial recommendations

-

Credit scoring alternatives

-

Voice-activated banking

3. Blockchain Implementations

-

Smart contract automation

-

Cross-border payment networks

-

Digital identity verification

D. Challenges Facing Digital Banks

1. Regulatory Hurdles

-

Varying licensing requirements by country

-

Anti-money laundering compliance costs

-

Data protection regulations (GDPR, CCPA)

2. Profitability Concerns

-

60% of neobanks not yet profitable

-

Customer acquisition costs averaging $50-100

-

Limited cross-selling opportunities

3. Security Vulnerabilities

-

Phishing attack risks

-

API integration weaknesses

-

Social engineering threats

E. Traditional Banks’ Counterstrategies

1. Digital Transformation Initiatives

-

Mobile app overhauls

-

Legacy system modernization

-

Partnership with fintech firms

2. Hybrid Banking Models

-

Flagship branches for complex services

-

Digital-first for routine transactions

-

Video banking options

3. Competitive Response Tactics

-

Matching digital bank features

-

Eliminating minimum balance requirements

-

Offering sign-up bonuses

F. The Future of Digital Banking

1. Embedded Finance Expansion

-

Banking-as-a-service platforms

-

In-app financial services

-

Social media payment integration

2. Hyper-Personalization Trends

-

Behavioral-based product recommendations

-

Context-aware financial guidance

-

Predictive cash flow management

3. Emerging Market Opportunities

-

Underbanked populations in Africa/Asia

-

SME-focused digital banking solutions

-

Government-backed digital currencies

Conclusion

Digital banks have irrevocably changed consumer expectations in financial services. While traditional institutions still hold advantages in trust and complex products, neobanks continue gaining market share through superior technology and customer experience. The future will likely see increased collaboration between these models, with the most successful players blending digital innovation with financial expertise. Banks that fail to adapt risk becoming obsolete in this new financial landscape.

Tags: digital banking, neobanks, fintech revolution, mobile banking, financial technology, banking innovation, challenger banks, future of finance, cloud banking, financial disruption